Do you ever find yourself wondering where all your money goes at the end of each month? Saving money can be a challenging task, but it is crucial for achieving financial stability and freedom. In this blog post, we will delve into the world of saving, uncovering the secrets to successful money management and providing you with practical tips to kick-start your savings journey.

Set Clear Financial Goals: To begin your savings journey, it is essential to establish clear financial goals. Are you saving for a down payment on a house? Planning a dream vacation? Or maybe building an emergency fund? Identifying your goals will give you a sense of purpose and motivate you to save consistently.

Create a Realistic Budget: Creating a budget is the cornerstone of effective money management. Track your income and expenses, and allocate specific amounts for different categories, such as housing, transportation, groceries, and entertainment. Be mindful of your spending habits and identify areas where you can cut back.

Automate Your Savings: Make saving effortless by setting up automatic transfers from your checking account to a savings account. This way, a portion of your income will be set aside before you even have the chance to spend it. Over time, your savings will grow consistently without requiring constant effort.

Cut Unnecessary Expenses: Take a closer look at your monthly expenses and identify areas where you can make cutbacks. Cancel unused subscriptions, reduce dining out, and limit impulse purchases. Remember, every penny saved is a step closer to financial freedom.

Prioritize Debt Repayment: High-interest debts can hinder your savings progress. Prioritize paying off credit card balances and other outstanding debts. Once you eliminate these financial burdens, you can redirect the money previously allocated to debt payments toward your savings.

Embrace Frugality: Embracing a frugal mindset can significantly impact your saving efforts. Look for discounts, compare prices, and consider buying used items instead of new ones. Small changes in your spending habits can lead to significant savings in the long run.

Increase Your Income: Finding ways to increase your income can expedite your savings journey. Consider taking on a side gig, freelancing, or exploring passive income opportunities. Use your additional earnings to bolster your savings and reach your financial goals faster.

Stay Committed and Stay Positive: Saving money requires discipline and perseverance. Keep your goals in mind and stay committed to your savings plan, even when it gets challenging. Celebrate your milestones along the way and stay positive. Remember, every small step you take brings you closer to financial freedom.

Saving money is not just about accumulating wealth; it is about gaining control over your finances and creating a secure future. By implementing these tips and strategies, you'll be well on your way to achieving the financial freedom you've always dreamed of. Start today and unlock the path to a brighter and more prosperous future!

Save on Everyday Expenses: Look for opportunities to save on your everyday expenses. Consider switching to a more affordable cell phone plan, cutting back on your energy usage, or using coupons and discounts when shopping. These small adjustments can add up to significant savings over time.

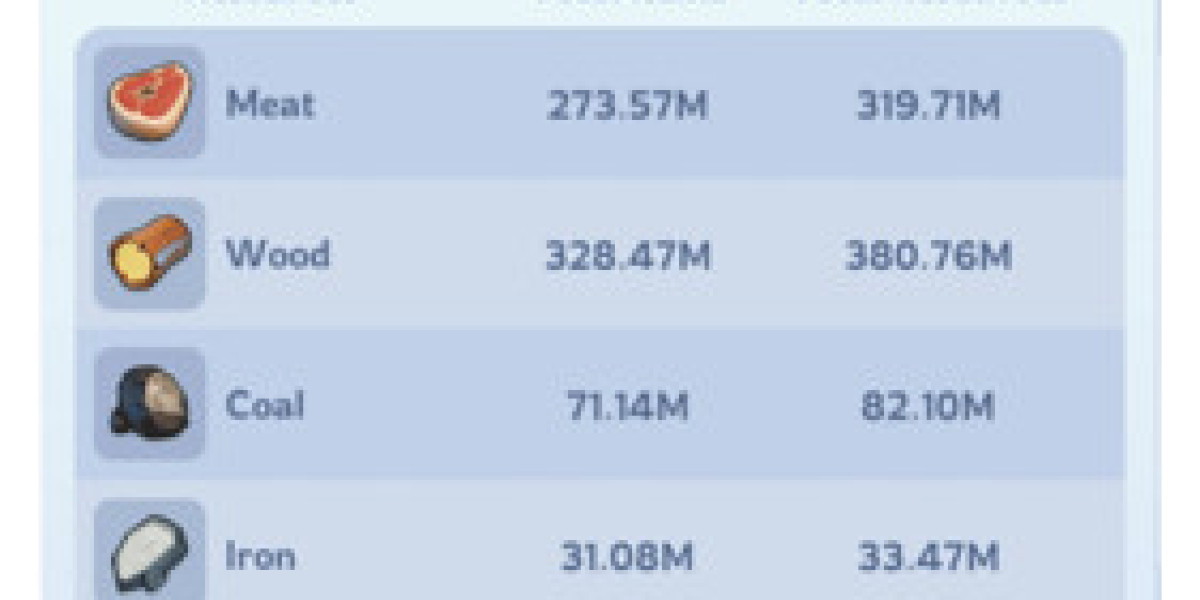

Track Your Progress: Regularly monitor your savings progress to stay motivated and make adjustments as needed. Keep a record of your savings goals, track your monthly savings contributions, and celebrate milestones along the way. Seeing your progress will encourage you to stay on track and continue saving.

Build an Emergency Fund: Building an emergency fund is crucial for financial security. Aim to save three to six months' worth of living expenses to protect yourself from unexpected financial setbacks. Having an emergency fund in place will provide you with peace of mind and prevent you from dipping into your long-term savings.

Invest Wisely: Once you have built a solid savings foundation, consider exploring investment opportunities to grow your wealth. Consult with a financial advisor to determine the best investment options based on your risk tolerance and financial goals. Investments can help you generate passive income and increase your net worth over time.

Stay Educated: The world of personal finance is constantly evolving. Stay up to date with financial news, read books and blogs, and listen to podcasts related to money management. Continuously educating yourself about personal finance will empower you to make informed decisions and optimize your savings strategies.

Avoid Impulse Spending: Impulse spending can quickly derail your savings efforts. Before making a purchase, give yourself a cooling-off period to evaluate whether it aligns with your financial goals. By practicing mindful spending, you can avoid unnecessary purchases and allocate those funds towards your savings instead.

Leverage Technology: Take advantage of various money-saving apps and tools available today. These apps can help you track your expenses, automate savings, and even find the best deals and discounts. Embrace technology as a powerful ally in your savings journey.

Remember, saving money is a long-term commitment. It requires patience, discipline, and the willingness to make conscious choices about your spending habits. By implementing these strategies and staying dedicated to your financial goals, you will gradually build a strong financial foundation and unlock the doors to financial freedom.